Getting in a car wreck can be an extreme life barrier and overly frustrating, especially if you were not responsible for the wreck. Not only may you have to deal with your medical injuries and trauma, but the logistics of managing to acquire a new vehicle, get your vehicle fixed, or receive payment for your medical bills from the responsible party’s insurance company can be extremely time-consuming. These are ultimately tasks that take away from matters that are much more important, such as managing you and your family’s health and getting back to your everyday life. The barriers of a wreck can be heightened by being unfamiliar with your auto insurance policy.

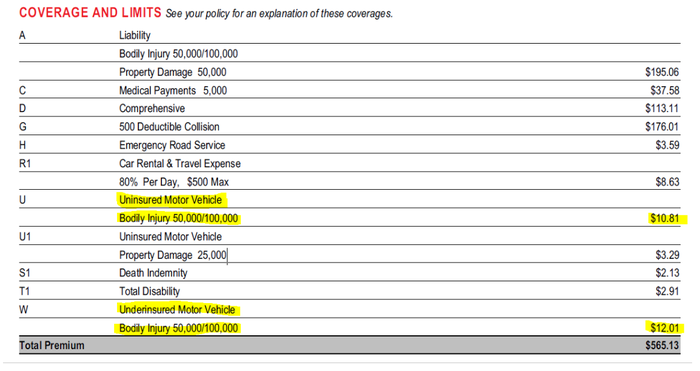

Clients often come to our office unaware of what their auto policy actually contains. Key coverages that we like to highlight are uninsured motorist coverage (UM) and underinsured motorist coverage (UIM). In the event that your wreck has caused you significant damage, these two policies can make life much easier and provide a safety net in the event that the responsible party’s insurance policy is insufficient.

UM coverage is meant to provide damage payments to you in the event that the responsible party is uninsured. Being hit by an uninsured driver can derail someone’s life, especially if the damages are high. You may fall responsible for your medical bills and damages, and many people do not have the cash on hand to manage these major costs. UM coverage is an essential aspect that you should look for in your policy. Driving without UM coverage is overly risky, and usually the additional cost of this coverage towards your total premium is not excessive. Acquiring UM coverage is low cost, high reward.

UIM coverage is a bit more complicated, but not anything an ordinary driver cannot understand. Your UIM coverage provides extra funds in the event that the responsible party’s insurance has a policy limit that does not provide for the total damage of the wreck. Often times, policy limits for bodily injury may be capped as low as $25,000 for an individual wreck. Sometimes (even in non-catastrophic wrecks) medical costs alone can exceed a low policy limit. If this is the case, your UIM coverage may provide funds to help cover the excess damages. Having UIM coverage provides you additional safety and usually does not add a tremendous cost to your premium. Again, low cost, high reward.

All too often we have clients that have damages that exceed the responsible party’s policy provisions, which leaves them in a hole for an event they were not responsible for. This can be life-changing and is not a “just” result. We recommend all drivers add UM and UIM coverage to their policies if they do not currently have it. Most of our clients left in predicaments where coverage does not meet their damages express sentiments that they “knew the risk when they entered the road,” but they “didn’t think it’d happen to me.” By then it is often too late to recover their full damages. UM and UIM coverage are one of the easiest ways to control for the everyday risk of driving, and when it comes to driving, it is always wise to be risk averse.

Learn more about auto insurance coverage

This image displays an example declarations page highlighting the UM and UIM policy provisions. The 50,000/100,000 represents the policy limits for an individual involved in the wreck ($50,000) and for the maximum coverage for the combination of all the people in the vehicle ($100,000).

a Free Consultation